Top 10 OEM & Aftermarket Auto Parts Stocks B2B Buyers and Enthusiasts Should Watch in 2024

As global demand for high-performance, reliable, and technologically advanced vehicle components continues to surge, discerning B2B buyers and passionate car enthusiasts are turning their attention to a critical factor: where these premium auto parts come from and who’s leading the charge. With the aftermarket and OEM auto parts market projected to exceed $800 billion in the coming years, driven by rising vehicle ownership, longer vehicle lifespans, and a growing appetite for customization and performance upgrades, the stakes have never been higher.

For businesses supplying repair shops, retailers, and distributors — and for enthusiasts seeking genuine quality and innovation — identifying the top companies behind the parts is essential. This isn’t just about sourcing components; it’s about investing in performance, durability, and trust. We’ve curated the Top 10 Auto Parts Stocks making waves in the industry — companies renowned for engineering excellence, strong supply chains, and sustained innovation. Whether you’re expanding your inventory or upgrading your dream ride, these market leaders represent the future of automotive excellence.

Top 6 Manufacturers & Suppliers of Auto Parts Stocks (2026 Review)

Ranked by inventory, reputation, and service quality.

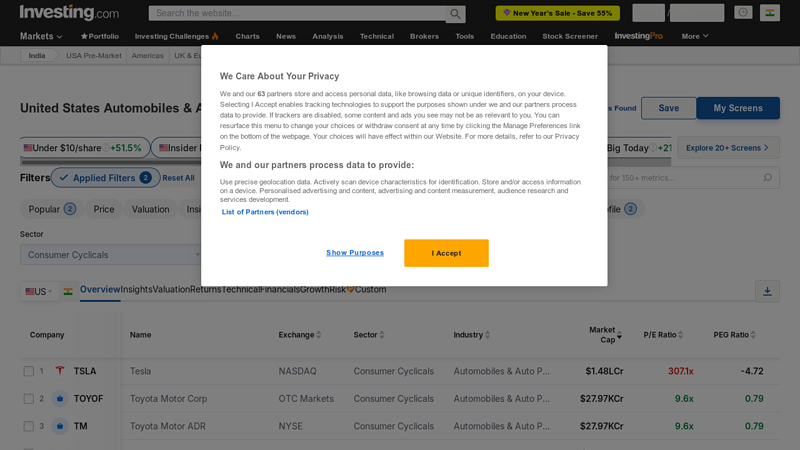

#1 United States Automobiles & Auto Parts Stocks

Domain Est. 1995

Website: in.investing.com

Access an extensive list of United States Automobiles & Auto Parts stocks through our advanced screener. Easily find the top companies, search, filter, …

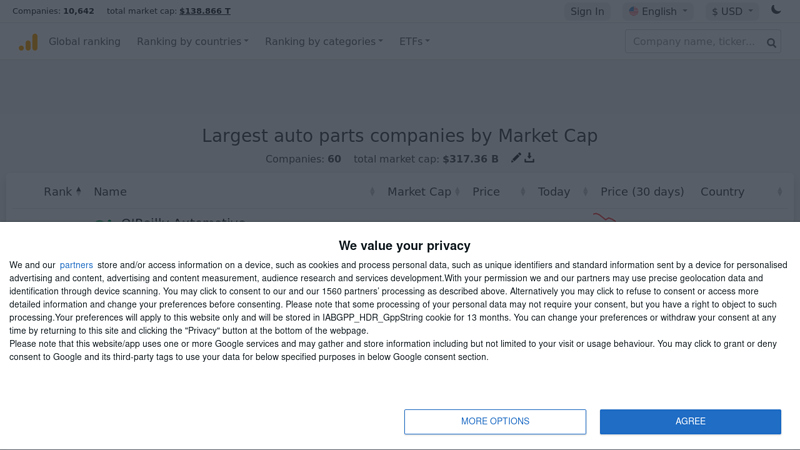

#2 Largest auto parts companies by Market Cap

Domain Est. 2020

Website: companiesmarketcap.com

List of the largest auto parts companies by market capitalization, all rankings are updated daily.

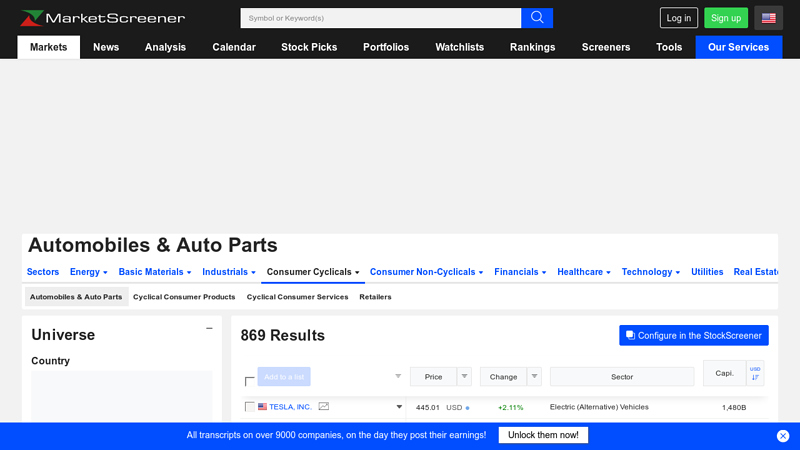

#3 Automobiles & Auto Parts: All listed companies

Domain Est. 2001

Website: marketscreener.com

868 Results ; GENERAL MOTORS COMPANY · Stock General Motors Company. 81.86USD ; CUMMINS INC. Stock Cummins Inc. 542.40USD ; MERCEDES-BENZ GROUP AG · Stock Mercedes …

#4 META_TITLE_SECTORS

Domain Est. 1995

Website: finance.yahoo.com

Ford Motor Co. manufactures automobiles under its Ford and Lincoln brands. In March 2022, the company announced that it will run its combustion engine business, …

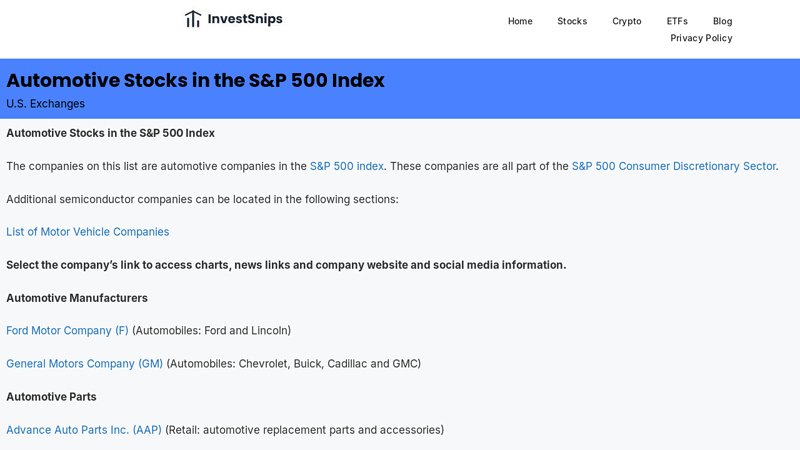

#5 Automotive Stocks in the S&P 500 Index

Domain Est. 2014

Website: investsnips.com

The companies on this list are automotive companies in the S&P 500 index. These companies are all part of the S&P 500 Consumer Discretionary Sector.

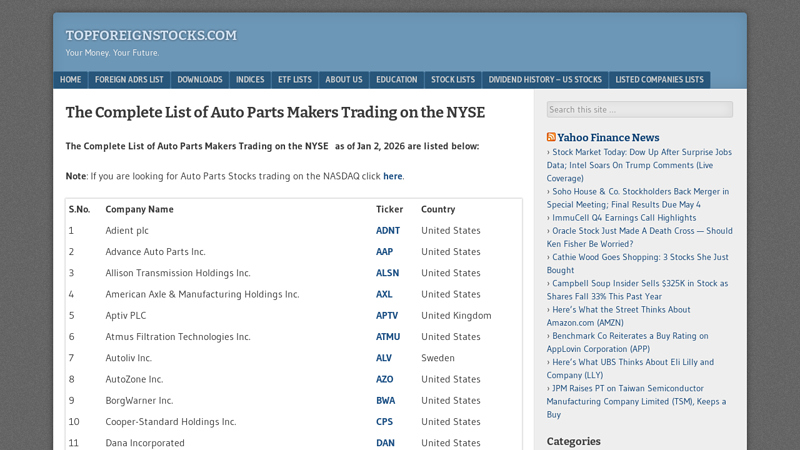

#6 The Complete List of Auto Parts Makers Trading on the NYSE

Domain Est. 2007

Website: topforeignstocks.com

The Complete List of Auto Parts Makers Trading on the NYSE ; 1, Adient plc, ADNT ; 2, Advance Auto Parts Inc. AAP ; 3, Allison Transmission Holdings Inc. ALSN ; 4 …

Buyer’s Guide: How to Choose Auto Parts Stocks

Buyer’s Guide: 3 Things to Check Before Buying Auto Parts Stocks

For B2B buyers and car enthusiasts investing in replacement components, choosing the right auto parts stocks is essential for performance, reliability, and long-term savings. Whether you’re sourcing for a repair shop, fleet maintenance, or personal project vehicles, not all auto parts stocks are created equal. To help you make informed purchasing decisions, here are three key factors to evaluate before placing your order.

1. Authenticity and OEM vs. Aftermarket Specifications

One of the most critical checks is confirming whether the auto parts stocks are genuine OEM (Original Equipment Manufacturer), OEM-equivalent, or aftermarket. OEM parts are built to the exact specifications of the original vehicle manufacturer, ensuring perfect fit and function. Aftermarket parts can offer cost savings and sometimes performance enhancements, but quality varies widely between brands. Look for certifications like ISO 9001, IATF 16949, or supplier endorsements from reputable automakers. Always verify part numbers, packaging, and supplier documentation to avoid counterfeit products that could compromise safety or void warranties.

2. Inventory Consistency and Supply Chain Reliability

For B2B buyers especially, consistent availability is as important as part quality. Evaluate the supplier’s inventory turnover, stock depth, and lead times. A robust auto parts stock should include year, make, and model coverage for popular and legacy vehicles. Ask about warehouse locations, restocking frequency, and whether they use real-time inventory tracking. Reliable suppliers often offer catalog integration with ERP or inventory management systems—streamlining reordering and reducing downtime. Avoid vendors with frequent backorders or limited SKU range, as inconsistent stocks can disrupt operations.

3. Warranty, Return Policy, and Technical Support

Even high-quality auto parts can occasionally fail or arrive damaged. Before purchasing, review the warranty duration and coverage terms—ideally 12 months or more with clear labor reimbursement guidelines. Check the return policy: Can defective or incorrect parts be exchanged quickly? Is return shipping prepaid? Also, assess the level of technical support provided. Suppliers with in-house engineers or ASE-certified advisors add value by helping troubleshoot compatibility and installation issues. Strong after-sales support ensures confidence in your auto parts stocks investment.

By carefully assessing authenticity, supply reliability, and post-purchase service, you can secure auto parts stocks that deliver performance, peace of mind, and long-term value—whether for a commercial enterprise or your next high-performance build.

These six options are excellent choices for investing in auto parts stocks because they collectively provide a comprehensive, diversified, and high-quality selection of industry leaders and key players. They include top companies by market capitalization, major constituents of the S&P 500, and a full range of firms listed on the NYSE, ensuring exposure to both established giants and a broad market perspective. By covering everything from U.S.-based manufacturers to the most influential automotive and auto parts companies, these lists offer investors well-rounded opportunities to build a robust portfolio aligned with the performance and innovation trends in the global auto parts sector.